I recently came across a really informative report on agribusiness titled Africa Are You In For The Ride? Agribusinesses Insights Survey 2014/2015

Considering that this is what FarmLift is about we offer the following highlights gleaned from this report by PwC

Role of Government

Africa is rapidly becoming a preferred investment destination. The continent houses almost 60% of the world’s uncultivated land and an abundance of natural resources. Agriculture and agribusiness together account for nearly half of the GDP in Africa (World Bank, 2013).

Due to the large percentage of uncultivated, fertile land and the presence of water, sub-Saharan Africa, countries in average annual growth rate of over 5% (DAFF, 2013). To take the African agricultural sector, with its enormous potential to the next level, public-private partnerships throughout the value of chain as a whole are key. The role of supporting governments in supporting the private sector to grow their businesses should not be underestimated.

According to Dr. John Purchase, “Despite Africa’s huge reliance on agriculture for its GDP, only a handful of countries invest 10% of their annual budgets in agricultural development, despite the MaputoDeclaration, signed by African Heads of State, committing to this target. Investment by African Governments in agriculture will send a profound signal to the private sector, and private sector investment will follow.” (DAFF, 2013)

As the world’s population increases rapidly (recently exceeding the seven billion mark), global agricultural production must rise to feed these growing numbers. Much of that increased agricultural production will come from Africa. Therefore, as obstacles to boosting agricultural output in Africa are overcome and agricultural output is increased there’ll be a business opportunity for the manufacture and marketing of products such as fertilizers, pesticides and seed as well as a demand for food-processing services such as grain refining.

Supporting this perspective, 72.7% of participating CEOs consider investment in other African countries as an opportunity for their agribusiness to expand.

Insight into Ghana according to Sarah-Mary Frimpong, PWC

Agriculture is a significant and established sector in the Ghanaian economy and contributes 23% of GDP. Ghana’s geographical area is conducive to agriculture. The coast of Ghana supports fishing and small-scale farming. The middle belt, occupying around a third of the country, is the main agricultural area where cocoa beans, the major export crop, are grown. Farmers also produce palm oil, rubber and pineapples for both export and local consumption. The northern belt is suitable for livestock rearing, as well as for growing yams, rice and millet, shea butter, cotton and kola nuts.

Agriculture in Ghana is not mechanised and takes place mainly on a small scale. Mechanisation would offer opportunities for the expansion of farms and growth in business incomes, but would require sustained investment, which is difficult to obtain. The majority of the produce is exported in its raw state and local processing and value adding to turn the produce into exportable commodities would increase local employment while also contributing towards a reduction in the export deficit and shrinking Ghana’s budget deficit.

The main threats and challenges to growth in the sector include the scarcity of capital, the lack of infrastructure development in the rural areas, and the high cost of farming inputs and utilities. However, there is collaboration between Government and the private sector to implement certain programmes that will address these challenges, increase yields and enhance productivity. Moreover, training programmes have been identified to improve the technical skills and competence of managers and farmers in order to increase their efficiency and productivity. Farmer training and education is being organised both at a national level through Government agencies and by donor partners such as AGRA, NORAD, and stakeholder companies through their foundations.

Insight Into Mauritius according to Andre Bonieux

Agriculture in Mauritius is synonymous with sugar cane. With a production of 650, 000 tons of sugar in the 70s, at the time the island is was truly a mono-crop economy. The whole sector has undergone major reforms, however, and the industry has shrunk in size to 415, 000 tons. Throughout this period, and in the last 20 years in particular, there have been many reforms in the sector, including a number of critical projects:

- Labour reduction plans – the industry has gone from 32, 700 employees in 2000 to 14, 700 in 2013

- Centralisation of sugarmills – since 1994, 10 mills have closed, leaving only four in operation in 2014

- Industry negotiated power supply agreements and finance agreements to build power plants at sugarmills – all four mills today are independent power producers (IPPs) and a number of those that closed were also IPPs

- Restructuring in the wale of price decreases and reforms brought about by the end of the sugar protocol that had been in place between the European Union and its ACP (Africa/Caribbean/Pacific) partner countries

- Raising cash through the realisation of land banks

- Industrial projects to produce refined and special sugars, and ethanol – the strategy of millers today is to develop a cane industry together with its side products – refined and special sugars, ethanol, and energy (by burning bagasse or cane pulp) – rather than merely producing sugar.

It is important to understand the global political and economic forces affecting demand for sugar.

The current issue is obviously the price of sugar which has been falling throughout 2014. From a net price of approximately $586/ton for crop year 2012, the equivalent price for crop year 2014 is closer to $390. This could be temporary, with a known global demand supply imbalance in 2014. Nevertheless, many doubt that the industry is sustainable at this price level. The recent weakening of the euro, the currency of the main export market for the island’s sugar, has added to the woes of the local industry. We expect yet more restructuring to happen in the industry, with farmers probably exiting their lower yielding fields in addition to implementing new cost cutting programmes. Some relief is also likely this year from the Sugar Insurance Fund which normally only pays compensation to farmers on account of crop losses due to cyclones and drought, but which could release some of its funds to sugar producers.

Five Global Megatrends

Megatrends are global, sustained and macroeconomic forces of development that impact businesses, economies, societies, cultures and personal lives. Those highlighted in this PWC report are:

- Demographic change

- Climate change and resource scarcity

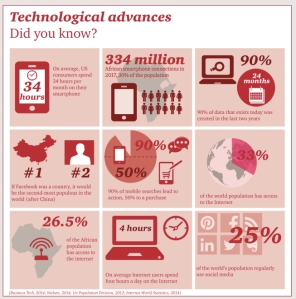

- Technological advances

- Accelerating urbanisation

- Shifts in economic power

Food Security according to Dr. Roelof Botha, PWC

Food security in most of the SSA region continues to be compromised by a combination of inadequate infrastructure, low income, volatile weather patterns, widespread poverty and a lack of food processing industries, which necessitates food imports.

In addition the majority of the populations in many SSA countries reside in rural areas, where road networks are in poor condition, raising the costs of logistics services. The challenges facing the attainment of a greater level of food security are further exacerbated by the prevalence of socio-political unrest and armed conflict in several SSA countries.

Challenges to Business Expansion

Compliance

Compliance is a part and parcel of any business. Often, businesses feel burdened by the number of systems and scorecardsthey have to comply with, but these also have their benefit in providing the necessary accreditation and legitimacy in terms of their sustainability. On being asked which accreditation systems agribusinesses currently comply with and potentially plan to comply with, it was evident that Hazard Analysis and Critical Control Points (HACCP) and ISO standards are a priority. Future compliance may include a carbon scorecard, as well as broad based black economic empowerment (BBBEE).

External audits and reviews pertaining to sustainability issues such as energy consumption, water consumption, chemical usage and health and safety are becoming more and more of a reality for agribusiness. A strong 82.8% of participation CEO’s indicated that they had been subjected to such reviews.

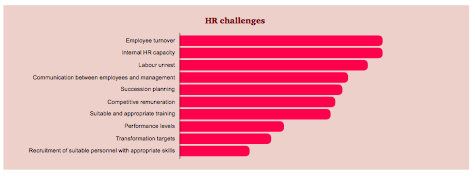

Overcoming HR Challenges

HR functions should go beyond their mere administrative support functions to play a more strategic role, working with agribusiness to reach its business strategy and to mould and equip the employees of the future, today.

The main challenges in HR are:

- Employee turnover

- Internal HR capacity

- Labor unrest

-

Communication between employees and management

-

Succession planning

The training focus areas pointed out by respondents, DAFF (2013) has identified the following skills that are needed within the agricultural sector:

- Literacy and numeracy skills

- Basic decision-making and problem-solving

- Leadership, planning and management skills

- Social, interpersonal and communication skills

- Negotiation and facilitation skills

- The critical thinking that is necessary for fostering innovation and change

- Marketing skills

- Business, income-generating and entrepreneurial skills

It is essential that agribusiness retain skills, invest in learning and development, and create opportunities for employees to grow and develop within the sector.

Technological Innovation

To remain competitive, agribusinesses need to pre-empt and respond effectively to the rapid pace of technological change in the agricultural sector globally. It is essential that all decision-makers understand technology, integrate their technology strategy with their business strategy, and actively manage technological innovation.

Smaller agribusinesses havea number of options to choose from when evaluating potential software packages/ERP systems. Traditional ERP vendors are moving downstream to find additional sources of customers and revenue in the small business segment, while a number of start-ups are providing niche solutions for smaller agribusinesses.

The majority of participating CEO’s (27.2%) indicated that they make useof custom software packages, 18.2% use Microsoft Dynamics Navision and 18.2% use SAP Business One within their agribusiness. Other software packages/ERP systems specified were IQ and QuickBooks.

A large number of CEO’s indicated that farm-level date and precision AG(soil, satellites, yield, etc.) played a very important role in their agribusinesses over the past ten years. In addition, all respondents indicate that farm-level data will gain a new level of meaning and importance if consolidated on one platform and if new live metrics are generated with artificial intelligence.

Other big opportunities identified were system integration, forecast demand and the ability to manage inventory, the availability of real-time data, and cloud storage to ensure information is always accessible.

Social Impact

The overall social consciousness of businesses and specifically agribusinesses is on the rise. All responding CEO’s indicated that their agribusinesses contribute towards corporate social investment (CSI) on annual basis. On average, participating agribusinesses spend 1.6% net profit after tax on CSI initiatives. This is above the required 1% that South African businesses forexample need to spend in order to achieve full points for the element of socio-economic development on the black economic empowerment scorecard, and it is also in line with global standards of CSI spend.

Future of Sustainability in Africa

The biggest drivers of environmentalsustainability consideration in the future, from most to least important:

- Resource scarcity, such as water

- Consumers

- Regulators

- Retailers

- Competitors

What are your thoughts on this report or the summary we provided? Do share your thoughts.

One thought on “Agribusiness Highlights for Africa 2014/2015 courtesy of PWC”